Category: Business Finance

Complimentary webinar shows organizations how to successfully receive data and dollars together with ACH payment.

Organizations can learn to balance the right mix of business financing options to maximize cash flow, improve working capital and lower DSO.

Increasingly popular video series helps viewers understand motorcycle company's financial situation and determine if there is real cause for concern.

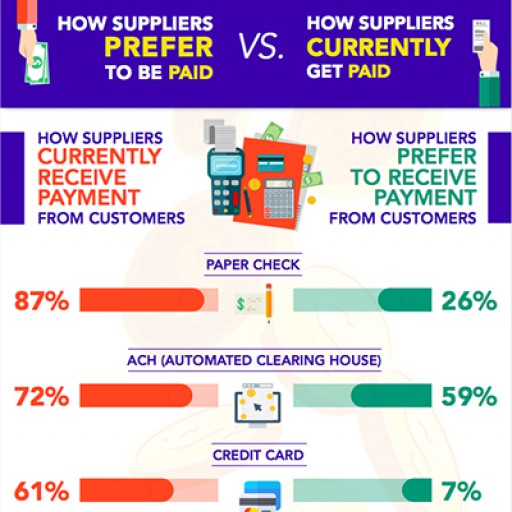

The most important aspect of the supplier-customer relationship shows both parties are regularly misaligned and have different objectives when it comes to payment.

Groundbreaking series brings rich content to suppliers, customers and other players within the supply chain.

Ernie Martin shares information on the current and future state of Artificial Intelligence and how it impacts financial institutions

Complimentary webinar identifies those practices that finance and receivables professionals can implement to streamline processes and improve cash flow.

Free webinar illustrates how receivables leaders can fix disconnected, individual processes that result in partial and diminished Credit-to-Cash automation.

New report provides insight into invoice-to-cash practices and preferences of companies across multiple industries and revenue strata

Comprehensive guide highlights early payment options and identifies the pros and cons for suppliers and customers

Webinar illustrates how smart financial executives can combine the latest technology with best practices to reduce DSO and drive Accounts Receivable efficiency

Simplified guide focuses on those Same Day ACH elements most essential to supplier organizations

What are the challenges to greater adoption of e-Invoicing in the U.S. and what are the recommended solutions to these challenges?

Network continues to become a powerful resource for world-class education, training and best practice information

Ernie Martin brings broad experience working with suppliers, customers and solution providers to facilitate education, opportunity growth.

Comprehensive resource helps supplier organizations improve operations and equips professionals responsible for any element of Order-to-Cash

Free webinar helps supplier organizations make sense of the increasing number of available portals and guides them in taking the best course of action.

The advancement of intelligent technology in recent years means that individuals and organizations no longer must rely solely on manual intervention to accomplish learnable tasks.

Second installment on how Brexit will impact the US. economy, tech industry and accounting practices.

The Brexit decision leaves in its wake a number of uncertainties and unknowns as well as a great deal of speculation.

Webinar focuses on those issues suppliers have indicated are most important to them regarding invoicing.

Approximately 1/3 of all organizations have no written credit policy, including a quarter of those with revenue between $100 million and $1 billion.

Free web clinic, hosted by Receivable Savvy with special guest Nicole Dwyer, Senior Vice President, Billtrust, illustrates how financial executives can master one of their more daunting challenges - successfully reducing DSO.

When the topic of electronic invoicing comes up, there are several misnomers in certain circles regarding what it actually is. The simple fact is that it can mean different things to different people.

Study provides insight on how customer payment is influenced by supplier industry, revenue and invoice volume.

Many large customers devote most of their attention to the 20% of suppliers that represent 80% of the spend.

The Free Best Practice guide was created to help organizations understand the habits and practices of top-performing companies, how they approach DSO reduction and how they go about getting paid faster.

Receivable Savvy and NACHA identify the necessary elements every company should know in order to incorporate ACH into their payment mix and maximize the Invoice-to-Cash process.

Receivable Savvy hosts a live, audience-driven, interactive discussion with industry expert Chris Doxey on January 17, 2015

When asked how they prefer to be paid, 63% of suppliers indicated ACH while only 25% indicated paper checks. If this is the case, then why are 83% of suppliers still being paid by paper checks?